|

Today's News |

Canadian Venture Capital and PE Association Report $11.8B Invested YTD, Surpassing Highest Annual Invested Dollars on CVCA Records

Wednesday, November 17, 2021

Toronto, ON, November 17, 2021--(T-Net)--The Canadian Venture Capital and Private Equity Association (CVCA) released today its 'Q3 - 2021 - Canadian VC & PE Market Overview' report.

VENTURE CAPITAL KEY FINDINGS: $11.8B Invested YTD Surpassing Highest Annual Invested Dollars on CVCA Records

CAD $3.5B was invested across 174 deals in the third quarter, bringing the year-to-date total to CAD $11.8B; propelling 2021 far beyond the previous highest annual VC investment of CAD $6.2B recorded in 2019.

With larger investment rounds taking place since the beginning of the year, the average deal size sits at a record-setting CAD $20.7M, which has roughly doubled since the CAD $11M in 2019, the previous highest year on record. The average growth stage investment YTD in Q32021 was CAD $129M, which has more than tripled over the last three years. Investments into later and growth-stage companies have received 63% of total VC dollars invested in Q32021, a significant increase from years prior (50% in 2019 and 49% in 2020).

There were 55 megadeals (CAD $50M+) year-to-date, accounting for 74% of total dollars invested in the year so far. Notable megadeals in Q3 included Vancouver-based Dapper Labs' CAD $319M closing, Toronto-based Clearco's CAD $270M funding, and the investment made in Montréal-based Blockstream for CAD $265M.

"Investment in Canada's startups has never been stronger," said Kim Furlong, Chief Executive Officer, CVCA. "With the recent crop up of new continuation funds and the average growth stage investment rising, we are seeing a willingness to hold with investors as they stay the course in their investments — a testament to the maturing Canadian venture ecosystem."

Merger and acquisition (M&A) activity continues the momentum from earlier this year, with 15 additional M&A exits, for a total of 34 M&A exits completed year-to-date Notable M&A exits include the acquisition of BC-based Redlen Technologies by Canon in September.

There were 2 additional VC-Backed IPOs in Q3, bringing the total number of VC-backed IPOs so far in 2021 to 4. In Q3, Burlington-based Anaergia Inc. and Toronto-based LifeSpeak Inc., both listed on the TSX.

PRIVATE EQUITY KEY FINDINGS: Canadian PE Investment on Track for CAD $20B Invested This Year; PE-Backed Exits Performing at Pre-Pandemic Levels

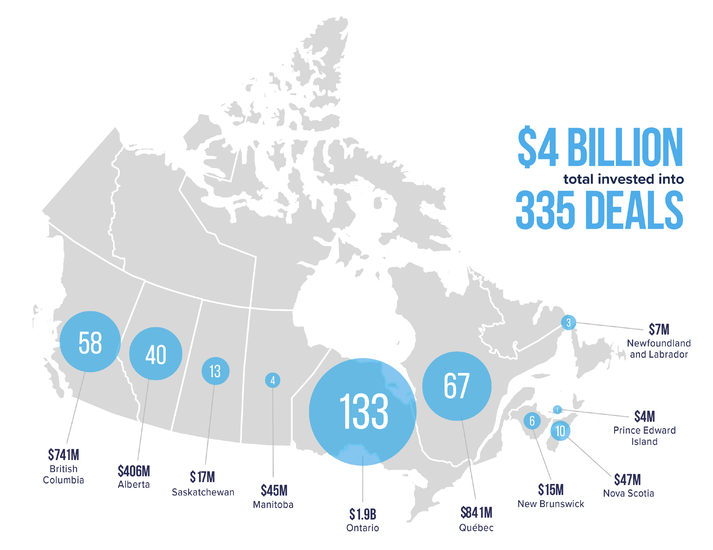

CAD $4.3B was invested across 206 deals in Q3, bringing the year-to-date total to CAD $13.2B invested across 584 deals; trending towards the highest annual number of PE deals on record (661 deals in 2019).

Of the 584 PE deals that closed in the first three quarters of 2021, 84% of the deals with disclosed values were under CAD $25M. There were four mega-deals (CAD $500M+), all of which closed in Q2, accounting for 33% of total dollars invested year-to-date (CAD $4.4B).

The information communication technology (ICT) sector continued to lead in the third quarter, accounting for 23% of all PE investment activity and 25% of all dollars invested, an indication of the maturing of Canada's tech sector. Investment in the financial sector only accounted for 4% of total activity, however, the sector experienced the third-highest share of dollars invested, 17% or CAD $2.2B. The industrial and manufacturing sector remained steady with 20% of all PE activity (114 deals).

"We are on the journey through post-pandemic recovery," said Kim Furlong, Chief Executive Officer, CVCA. "Some of the performance figures we're seeing in Q3 are trending towards pre-covid levels. The consumer and retail sector, for example, has seen some significant investment growth, at almost five times the levels experienced since a low in 2018. The majority of PE investment so far this year was under CAD $25M - directly connected to our SMEs and demonstrating the critical role private equity plays in Canada's recovery."

2021 is on track to be the year with the most PE-backed IPOs on record and is already tied in second with 2017 with 5 IPOs overall. There have been 54 PE-backed exits in 2021 overall, with 35 M&A transactions and 14 secondary buyouts. 2021 is pacing well above pre-pandemic levels, with total activity in 2019 at 44 exits, but behind the all-time high set in 2017 at 151 exits.

Other Recent Company News  |

|||||||||||||||||||

|

|||||||||||||||||||

News

News Events

Events Tech Careers

Tech Careers Directory

Directory Tech Stocks

Tech Stocks T-Net 100

T-Net 100 Members

Members Feedback

Feedback About T-Net

About T-Net Employers

Employers Post Job Listings

Post Job Listings Advertise

Advertise