|

Today's News |

BBTV Announces Q2 2022 Financial Results, Net Loss Rises Sharply to $14.2 Million in 2nd Quarter

Monday, August 15, 2022Company Profile | Follow Company

Vancouver, BC, August 15, 2022--(T-Net)--BBTV Holdings Inc. (TSX: BBTV) (OTCQX: BBTVF), a media tech company that uses technology enabled solutions to help content creators become more successful, today announced financial results for Q2 2022 and six month financial results for the period ended on June 30, 2022.

All dollar amounts are expressed in thousands of Canadian dollars except where otherwise indicated.

Shahrzad Rafati, Chair and CEO, BBTV

"Q2 2022 results show continued strong growth in higher margin Plus Solutions," said Shahrzad Rafati, Chairperson and CEO of BBTV. "Plus Solutions revenue grew 29% compared to Q2 2021 and by 46% for the first half of the year and we are reiterating our guidance for over 40% growth in that segment for 2022. Although our Base Solutions revenue remained flat sequentially and declined year-over-year, we see significant fundamental tailwinds driving revenue contribution in our business. These tailwinds include the expedited activation of YouTube Shorts monetization, which could be worth up to approximately $90 million in incremental revenue, and the diversification of our Base Solutions to additional platforms like Facebook. Together with our cost optimization programs, we see a clear path to Adjusted EBITDA profitability for the business."

Q2 2022 Financial Highlights:

- Plus Solutions revenue in Q2 2022 grew by 29% in comparison to the same quarter last year and in Q2 2022 represents 13% of total revenue and 30-40% of total Adjusted Gross Profit[3].

- Plus Solutions revenue growth is expected to exceed 40% on an annual basis for 2022.

- The revenue from the Company's core Plus Solutions, specifically Content Management, Direct Advertising Sales and Mobile Gaming Apps, grew by a combined 41% in Q2 2022 in comparison to the same quarter last year.

- Based on forecasts and Adjusted EBITDA breakeven timelines, management is comfortable that it has adequate liquidity for at least the next 12 months.

- All shareholder margin loans secured against BBTV shares have been paid off.

- The Company undertook a cost optimization initiative where it reduced total headcount by approximately 14%. The effects of this cost optimization initiative will be reflected in the Company's results from Q3 2022 onwards.

(1) These figures are derived from the Company's IFRS financial statements. Adjusted Gross Profit and Adjusted EBITDA are non-GAAP financial measures and Gross Margin Excluding PPA Amortization is a non-GAAP ratio. These terms are defined under "Key Metric Definitions" below. A reconciliation of non-GAAP financial measures and non-GAAP ratios are set out below under "Non-GAAP Financial Measures and Non-GAAP Ratios Reconciliation Tables".

- Adjusted Gross Profit[3], which is a non-GAAP financial measure and defined as Gross Profit excluding amortization associated with the purchase price allocation ("PPA") related to the initial public offering, for Q2 2022 was $8.3 million, a 10% decrease in comparison to $9.2 million reported for the same quarter last year due to the decrease in revenue across Base Solutions.

- BBTV Share{3} of revenue, which is a non-GAAP financial measure and defined as revenue less content creator and third-party platform fees, for Q2 2022 was $8.7 million, an 11% decrease compared to $9.7 million reported for Q2 2021.

- Gross Margin Excluding PPA Amortization[2], which is a non-GAAP ratio and defined as Adjusted Gross Profit[1] divided by revenue, was 8.3% in Q2 2022 up from 7.8% in Q2 2021 due to the higher revenue mix of Plus Solutions. Plus Solutions should continue to help contribute to further margin expansion in future quarters. Management expects Gross Profit to grow at a faster pace than the Company's top-line revenue.

- Adjusted Gross Margin[2], which is a non-GAAP ratio and defined as Adjusted Gross Profit divided by BBTV Share[3], was 95.5% for Q2 2022, comparable to 94.9% reported for Q2 2021. Adjusted Gross Margin[2] should remain stable and above 90% for the foreseeable future.

- The current period decrease in cash outflows from operating activities over Q2 2021 was primarily due to the changes in the timing of receipts or payments of working capital items.

(1) These figures are derived from the Company's IFRS financial statements. Adjusted Gross Profit and Adjusted EBITDA are non-GAAP financial measures and Gross Margin Excluding PPA Amortization is a non-GAAP ratio. These terms are defined under "Key Metric Definitions" below. A reconciliation of non-GAAP financial measures and non-GAAP ratios are set out below under "Non-GAAP Financial Measures and Non-GAAP Ratios Reconciliation Tables".

The current period decrease in cash outflows from operating activities over Q1 2022 was primarily due to the changes in the timing of receipts or payments of working capital items.

Q2 2022 Key Metrics:

Revenue for the three months ended June 30, 2022 decreased by $18.1 million or 15% when compared to the same period of the prior year. This decline in revenue for the current three-month period was due to a decline in Views and RPMs, partially offset by an increase in revenue in the higher margin Plus Solutions revenue stream.

Outlook:

BBTV monetization is closely tied to the performance of YouTube. Recently, YouTube's parent, Alphabet, reported that YouTube revenue growth slowed sequentially and year-over-year. This is primarily due to a switch in consumer preference to micro-content (less than a minute long videos) across all major platforms.

YouTube successfully introduced YouTube Shorts last year to respond to consumer preferences driven by the growth of TikTok, and this format now represents over 20% of BBTV's views. However, as the Company has stated in previous conference calls, they have yet to be monetized.

Alphabet announced during their most recent earnings conference call that they are accelerating their plans to monetize YouTube Shorts, which should cascade through to BBTV. Monetization is starting ahead of expected timing. Once it becomes monetized across BBTV's entire library, revenues attributable to YouTube Shorts views could represent incremental revenue of approximately $90 million dollars annually across our Base Solutions at current market rates and we therefore expect our overall blended RPMs to trend upward.

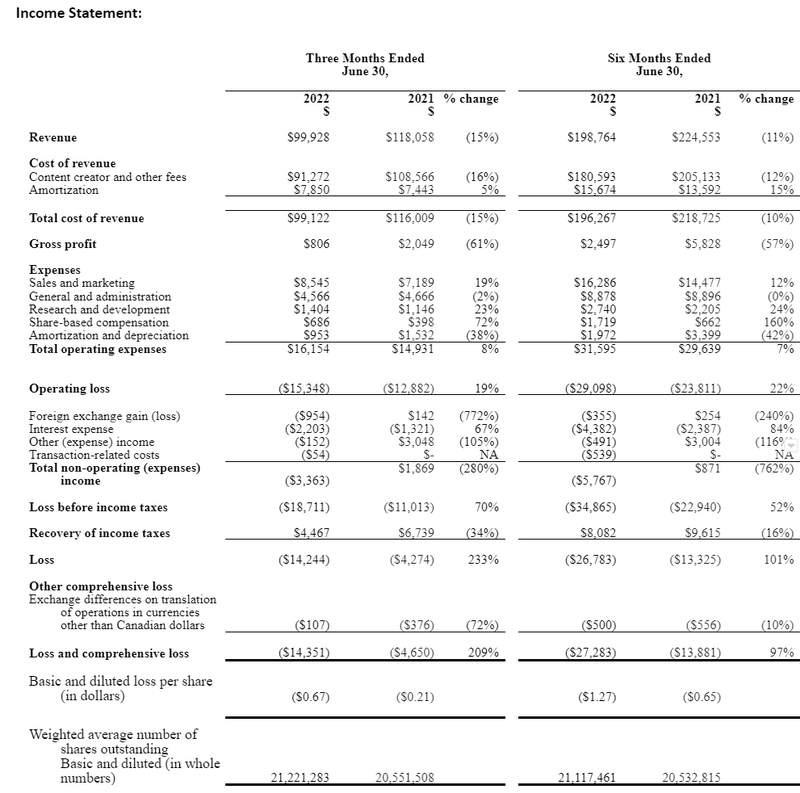

Income Statement

Non-GAAP Financial Measures and non-GAAP Ratios Reconciliation Tables

Adjusted EBITDA and Adjusted EBITDA Margin

BBTV Share, Adjusted Gross Profit, and Adjusted Gross Margin

Free Cash Flow

About BBTV

BBTV is a global media and technology company headquartered in Vancouver, Canada. The Company's mission is to help content creators become more successful. With creators ranging from individuals to global media brands, BBTV provides comprehensive, end-to-end Solutions to increase viewership and drive revenue powered by its innovative technology, while allowing creators to focus on their core competency - content creation.

In December 2021, BBTV had the fourth most unique monthly viewers among digital platforms with more than 600 million globally, who consumed more than 35 billion minutes of video content [1]. (www.bbtv.com )

The Management Discussion and Analysis ("MD&A"), along with full financial statements are posted and available on SEDAR at www.sedar.com.

[1] Calculations and classifications made by BBTV based on data from Comscore's "Top 12 Countries = December 2021 comScore Video Metrix Media Trend - Multi-Platform - Top 100 Video Properties Report"; Top 12 countries represent ~50% of world's digital population.

Links to SEDAR filings, conference call recordings and press releases are available on the investor website at: https://investors.bbtv.com/

Key Metric Definitions

The information presented within this press release includes certain financial measures such as non-GAAP financial measures, non-GAAP ratios, and supplementary financial measures, as well as a non-financial performance measure (collectively, "Key Metrics") to assist investors in assessing the overall operating performance of the Company. These measures are provided as additional information to complement IFRS measures by providing further understanding of our results of operations from management's perspective. Accordingly, these measures should not be considered in isolation nor as a substitute for analysis of our financial information reported under IFRS. They are not standardized measures under IFRS and do not have standardized meanings prescribed by IFRS, and might not be comparable to similar financial measures disclosed by other issuers. These Key Metrics are used to provide investors with supplemental information on our operating performance and thus highlight trends in our core business that may not otherwise be apparent when relying solely on IFRS measures. We also believe that securities analysts, investors and other interested parties frequently use Key Metrics in the evaluation of issuers. Our management also uses Key Metrics in order to facilitate operating performance comparisons from period to period, to prepare annual operating budgets and forecasts and to determine components of management compensation.

The numbers for the Company's Key Metrics and related information are calculated using external industry data sources and/or internal company data. These measures may be different from non-GAAP financial measures or ratios or other metrics used by other companies and may not be comparable to similar meanings prescribed by other companies, limiting their usefulness for comparison purposes. Moreover, some of these adjustments or measures are provided for period-over-period comparison purposes, and investors should be cautioned that the effect of the adjustments provided herein is not indicative of the actual effect on the Company's operating results.

Non-GAAP Ratios contained in this press release are:

"Adjusted Gross Margin" means Adjusted Gross Profit divided by BBTV Share; and

"Adjusted EBITDA Margin" means Adjusted EBITDA divided by revenue.

"Gross Margin Excluding PPA Amortization" means Adjusted Gross Profit divided by revenue.

Non-GAAP Financial Measures contained in this press release include all financial figures with a Pro-Forma Adjustment (see Pro Forma Basis) as well as the following:

"Adjusted EBITDA" means net earnings or loss, as applicable, before finance expenses, income tax expense (recovery), amortization and depreciation, share-based compensation, unrealized and realized gains or losses due to foreign exchange, transaction-related costs, and certain other items as set out in the reconciliation table;

"BBTV Share" means revenue less content creator and third-party platform fees;

"Adjusted Gross Profit" means gross profit plus amortization associated with intangible assets acquired as part of the Business Combination Transaction;

"Free Cash Flow" means cash flows from (used in) operating activities less purchases of property and equipment and purchase or development of intangible assets;

See the financial tables above for a reconciliation of the non-GAAP ratios and non-GAAP financial measures.

Supplementary Financial Measures

Supplementary Financial Measures contained in this press release are:

"Advertising Revenue" means the revenue generated from advertising sales from the Company's owned and licensed video on demand content across digital platforms, rights management revenue from advertising sales on video on demand content, and in-app advertising on Mobile Gaming Apps.

"RPMs" or "Revenue per one thousand video Views" means the Advertising Revenues for every thousand Views generated by the Company's owned and licensed digital content. The Company does not provide a reconciliation for RPMs as there are no directly comparable IFRS measures for the components that make up RPMs.

"Gross Margin" means gross profit divided by revenue.

We monitor Advertising Revenue and RPMs to help us evaluate our business, measure our performance, identify trends affecting our business, formulate business plans and make strategic decisions. These measures are also used to provide investors with supplemental measures of our operating performance and thus highlight trends in our core business that may not otherwise be apparent when relying solely on IFRS measures. Unless the context otherwise requires, the Company believes that readers should consider the applicable metrics to be indicative of engagement and monetization trends that are key factors that affect the Company's revenue. The Company may or may not update these metrics based on the Company's determination of applicability, circumstance, relevance or other considerations.

Non-Financial Performance Measures

Views are one of BBTV's non-financial performance measures and are defined as the number of views, in billions, of the Company's owned and licensed digital video content on various platforms, notably YouTube, for the stated period. The presentation of Views is reliant on certain third-party industry data and therefore is not comprehensive and may exclude views of the Company's content on certain platforms or in geographies whereby such data sources are unable to or do not track such information. Trends in Views affect revenue and financial results by influencing the Company's volume of salable media inventory, RPMs, as well as its product offerings, expenses and capital expenditures.

While Views are reported using reasonable judgments and estimates of the audience and its engagement with its content for the applicable period of measurement, there are certain challenges and limitations in measuring the usage of its content across its audience. Such challenges and limitations may also affect the Company's understanding of certain details of its business. For example, the methodologies used to measure the Company's Views and RPMs (see "Supplementary Financial Measures" above) may be susceptible to algorithm, calculation or other technical or human errors, and following an acquisition or strategic transaction, certain data may be, among other things, integrated, analyzed and reported differently by the Company than it was by the target or the strategic partner. Moreover, the Company's or its data provider's business intelligence tools may experience glitches or fail on a particular data backup or upload, which could lead to certain customer activity not being properly included in the calculation of Views and RPMs. Although the Company typically attempts to address and correct any such failures and inaccuracies relatively quickly, its reported Views and RPMs are still susceptible to the same and its estimations of such metrics may be lower or higher than the actual numbers.

|

Forward-Looking Statements

|

Other Recent Company News  |

||||||||||||||||||||

|

||||||||||||||||||||

News

News Events

Events Tech Careers

Tech Careers Directory

Directory Tech Stocks

Tech Stocks T-Net 100

T-Net 100 Members

Members Feedback

Feedback About T-Net

About T-Net Employers

Employers Post Job Listings

Post Job Listings Advertise

Advertise